Keeping up with the ‘Great Social Migration’

In the last two years, the social media landscape has undergone major changes resulting in shifts of user behavior and platform adoption. Twitter got a new owner and a new name (X). Geopolitical concerns for user safety on TikTok introduced the threat of a ban in the US as well as two ban extensions, leaving major questions over the platform’s future. New platforms: Threads, Blue Sky, Lemon8, Flip, and RedNote have taken turns in the spotlight as new options for users, brands, and creators to stake their claim. So, which new platforms have staying power? And which legacy platforms can evolve to meet the wants and needs of users and creators?

Meet the Newcomers:

Threads: Established July 2023. Threads was introduced by Meta to be a direct competitor to X. The platform is intended to feature short, text-based posts where users can catch up on news, sports, and more. Threads has an estimated 275 million monthly active users. As of January 2025 Meta announced an initial test of ads on Threads beginning with selected users/brands in the U.S. and Japan, which right now excludes pharma. Advertisers will be able to take advantage of Meta’s existing advertising platforms which could be a benefit to many advertisers.

Blue Sky: Established in 2021. Blue Sky was developed by former Twitter CEO, Jack Dorsey, and Jay Graber to be the first social network not controlled by a single entity. The decentralized platform has a similar look and feel to X with added features to encourage community and customization for the individual user experience. Blue Sky has over 30 million users as of January 2025. Although advertising is not yet available for the platform, listening is, and can help to provide brands with additional information regarding patient and HCP perceptions and sentiment around brands. Despite advertising not being present, some brands and advertisers are claiming their space on the platform in the form of blank pages. Some non-pharma brands are also sporadically making use of the platform for organic content. Advertisers do have the option to post organically on the platform yet.

Lemon8: Established in Japan in 2020 and made its US debut in February of 2023. Lemon8 is currently owned by Bytedance, the same company that owns TikTok. Lemon8 shares similarities with TikTok’s scrollable, video based “For You” page, while also resembling Instagram and Pinterest’s focus on visual content and curated slideshows. Lemon8 has an estimated 1 million daily active users in the US and over 12.5 million monthly users globally. Although Lemon8 does not currently offer formal advertising features, some brands and influencers are using the platform through organic content creation and partnerships. Because of the similarity between Lemon8 and TikTok this platform opens itself up to content creation and the possibility for influencer marketing.

Flip: Established in 2021. The Flip app gained traction in early 2025, benefiting from the potential threat of a US TikTok ban. Flip is a shopping based platform where users can scroll through user-generated videos of various products that are available for sale. If a user purchases a product on Flip, they have the opportunity to film a review, post it on the platform, and potentially earn money. The Flip app has been downloaded over 5 million times with more than half a million downloads occurring in January of 2025. Advertising is available but focused more on e-commerce/ direct buys. With this said, the platform significantly relies on the use of influencers/ reviewers to share and sell products.

RedNote: Established in 2013. RedNote is considered China’s answer to Instagram, with a layout similar to Pinterest (displaying multiple posts at the same time) and a focus on travel, makeup, fashion and shopping. Users can post short videos, engage in live chats, call each other and even purchase products within the app. RedNote also gained significant notoriety in the US at the height of the proposed TikTok ban. At its peak, RedNote reached 3.4 million daily active users in the US. That number is estimated to be significantly lower after the threat of a TikTok ban was delayed. Rednote does provide advertising opportunities but is mostly seen as an ‘influencer marketing agency’ with mostly beauty and fashion brands using the platform to advertise.

BeReal: Established in France in 2020, BeReal gained widespread popularity, especially on college campuses, in 2022. Users get a daily notification from the app encouraging them to share candid photos of themselves and their friends in daily life, given a randomly selected two-minute window each day. The app’s widespread popularity on college campuses was due, in part, to its paid ambassador program, though momentum waned by 2023. A resurgence occurred after a campaign at the Paris Olympics in 2024 and brought the app back into conversation, By June 2024, BeReal was acquired by French company Voodoo for $500 million. As of April 2025, the app reports it has about 40 million monthly users and is beginning to roll out ads in the United States. Initial products include in-feed ads in the app’s signature dual-camera post style, as well as complete brand takeovers.

OpenAI: According to multiple sources, OpenAI is actively working on its own X-like social network.The project is still in early stages, but it is said there is an internal prototype focused on ChatGPT’s image generation that has a social feed. Whether OpenAI plans to release the social network as a separate app versus integrate it into ChatGPT is unclear, though it is worth noting that ChatGPT became the most downloaded app globally in March 2025. While a social app would give OpenAI its own unique, real-time data that X and Meta already have to help train their AI models, it would also put OpenAI in more direct competition with these (and other) platforms.

Legacy Social Platforms:

Twitter: Established in March 2006 and publicly launched in July of that year, Twitter (originally Twttr) was introduced as a microblogging short messaging service (SMS). The company has since been sold to Elon Musk and rebranded as X, and as of early 2025 has a reported 586 million monthly active users.

Reddit: Established in 2005 and acquired by Conde Nast Publication in 2006, Reddit was founded as a news aggregation and forum based social media platform. The platform stands out as it is based on a network of communities based on user generated content. As of Q1 2025, Reddit has an estimated 108m daily active users.

YouTube: Established in 2005, YouTube is the second most visited website in the world, after Google Search. The platform was established as an online video-sharing platform offering a wide variety of user-generated as well as corporate media videos. As of January 2025 YouTube has over 2.5 billion monthly active users.

Meta- Instagram/Facebook: Facebook was established in 2004 as TheFacebook, with membership initially restricted to students at Harvard and became available to anyone over 13 in 2006. The platform was initially created to be a college networking site but expanded to a global networking service. Instagram was officially launched in 2010 and acquired by Facebook in 2012. The platform was created as a video and photo sharing social networking service. As of 2025 Instagram has 2 billion monthly active users and Facebook has over 3 billion monthly active users.

TikTok: TikTok officially launched in 2016 in China with international release in 2017. The platform is based on short-form only videos which hosts user-submitted videos that range in duration from 3 seconds to 60 minutes. In 2024 a bill was passed in the US which required TikTok to part ways with its parent company ByteDance within 180 days or face a ban in American app stores. The ban was initially given a 75 day extension and has since seen a second extension. As of February 2025 TikTok has over 1.5 billion monthly active users.

Research from CMI Media Vitals shows that both HCPs and consumers have a similar pattern of social media usage in that they both most frequently use legacy platforms like YouTube, Facebook, Instagram, and TikTok. HCPs reported that their most frequently used (frequently / always) social platforms were YouTube (25% /10%), Facebook (22% / 9%) and Instagram (15% / 7%), followed by LinkedIn and X (9% / 3%). Patients and caregivers reported that their most frequently used (every day / once a week) platforms were Facebook (63% /14%), YouTube, (44% / 22%) and Instagram (35% / 14%), followed by TikTok (24% / 13%). Where these user groups differ in their usage of these platforms is mainly in the types of content they engage with. Caregivers and patients commonly seek out communities to engage with people in similar situations, treatment resources, or first hand patient experiences taking a particular treatment. These conversations happen frequently on Facebook, Instagram, TikTok and Reddit. On platforms like X and LinkedIn, HCPs will typically seek out conference information, new trial data or product approvals, clinical trials and case studies. While patients and caregivers share a common interest in learning about potential new medications, they are less focused on the scientific aspects of a product launch or phase of clinical trial.

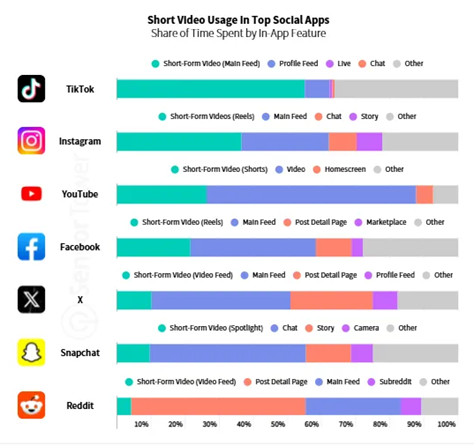

In a new report released by Sensor Tower, the subject of legacy platform popularity is addressed head-on with research around key mobile app shifts from 2024. The report highlights the ongoing power of social media apps and which apps remain the most popular. Instagram took the #1 place for most popular platform worldwide in downloads with 1% YoY growth. The same research showed that short-form video likely contributed to this rise in downloads as Meta has benefited from making Reels a focus, and has paid off in the form of higher user engagement. In fact, Sensor Tower data reveals the “US Facebook user time spent on Reels in December 2024 increased 17% from January 2024, equating to millions of engagement hours shifting to the feature.” Each legacy platform has its own nuances and popularity in in-app features with those highest downloaded platforms seeing more time spent on short form or video features (as shown below). With that said, platforms making use of short-form video like IG/FB, TikTok, and YouTube are all influencer centric, making these platforms ideal for influencer activation.

While Instagram saw the most app downloads in 2024, Pew Research released a report focused on U.S. consumers’ use of social platforms. YouTube was reported to be the most used platform by consumers, followed by Facebook and Instagram. Women were more likely to use Facebook and Instagram than men. These metrics similarly match research from Statista which shows Facebook, YouTube, and Instagram as the most used social networks worldwide by monthly active users.

Connect with CMI Media Group on LinkedIn.

For latest news and updates, follow us on Instagram, LinkedIn, and Facebook.

Questions? Thoughts? Ideas? Contact us.