State of PoP

April 11, 2024

“Point of purchase” is a term used by marketers and retailers when planning the placement of product information or promotion such as in display units, physical or digital, to strategically influence the consumer / patient. Often, these units surround common areas of shopping, in aisle or category, or at the point of sale or transaction such as the POS system or at the pharmacy. Historically, we think of point of purchase as a term used in a physical retail location where we are transacting for an OTC or consumer good. However, with the global shutdowns created by COVID-19, there was an immediate need for even the largest retailers to make shifts to a larger digital footprint with stores closed under lock and key.

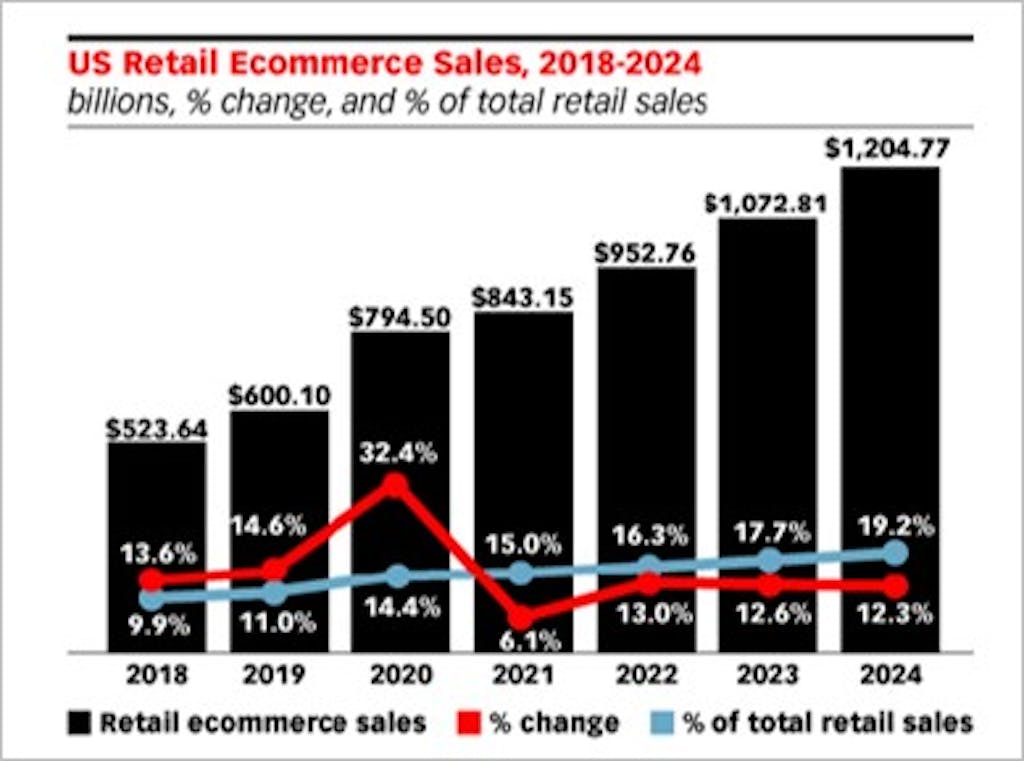

The year 2020 saw a major shift from retail brick and mortar to online shopping with e-comm sales increasing 43% generating $4.29T in 2020. Many would say that this was due to lockdowns, sales online have not slowed down with an average 12% increase YoY. With the understanding of how large this market truly is and seeing the results of patients unable to get healthcare provided to them as a result, major retailers began to fill the gaps in the pharmaceutical industry. Retailers recognized a need for more communication between HCP and patient, an increased efficiency in getting Rx products to the patient, and a missed opportunity for patients to be aware of products that my help them treat their disease state or condition.

Amazon

No surprise, as this has been the case over the last decade, Amazon was first to make a move. Though they were not first in the vertical, Amazon made a major splash investing north of $10B in the vertical over the last four years. They have invested $4B in the acquisition of One Medical physical medical clinics. The retail giant paralleled that effort with the acquisition of PillPack for just over $750M. With these new entities, Amazon then opened Amazon Pharmacy, digitally opening direct to consumer capabilities with fast and easy fulfillment, reminders for adherence, and open opportunity to scale marketing efforts with contextual based offers.

Amazon isn’t the only retailer who made efforts to close the gap. Walmart has launched a Healthcare Research Institute to increase community access to healthcare. Walgreens and CVS have opened communication channels using pharmacy script data to allow for direct access to information on new and soon to be dispensed pharma products across display, social, and several other avenues. In brick and mortar, these chains have also opened avenues for advertisement and communication in the aisle using shelf talkers and throughout the store with installations and kiosks. In many cases, the efforts of these retailers, Kroger, CVS, Walgreens, have worked directly with CMI Media Group to continue to evolve these opportunities and build a greater presence online withing the vertical.

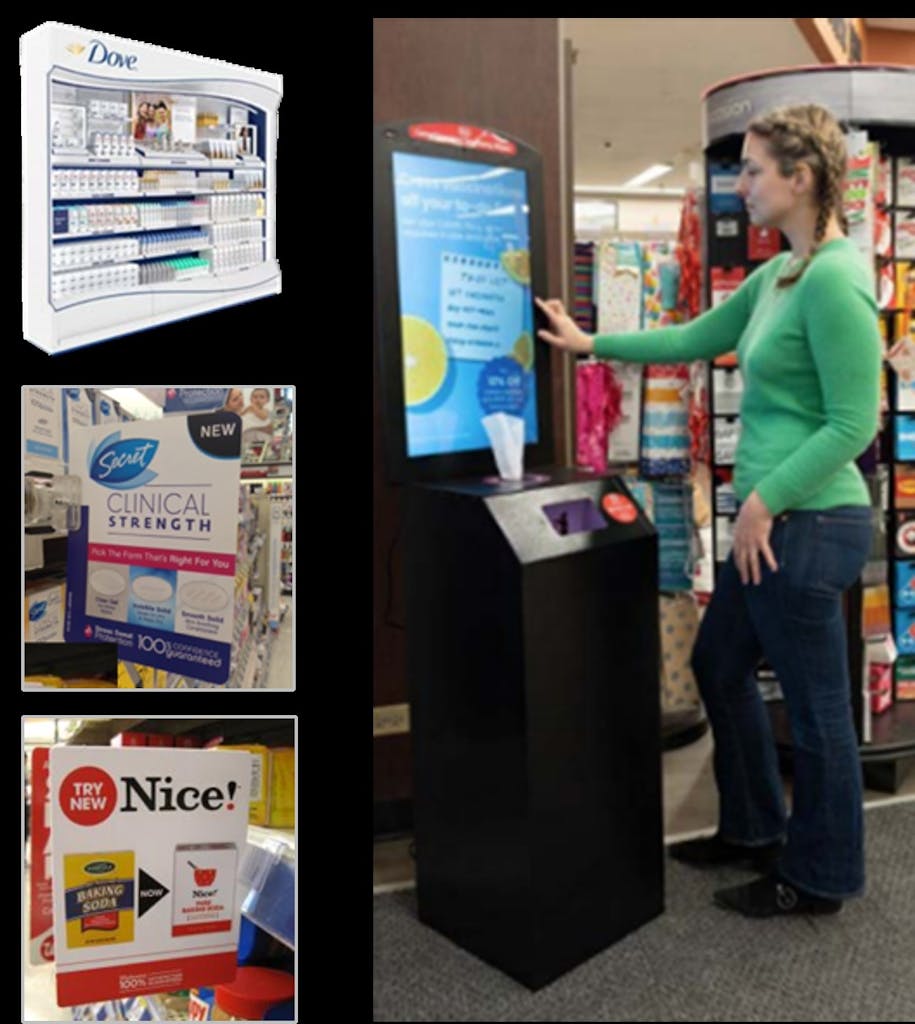

The first toe in the water for many of these retailers has been efforts in store. Due to regulatory adherence, it is much less effort to place a shelf-talker or kiosk in a store than it is to do so digitally. In these scenarios, retailers have opened analytics to show over the counter sales within category, identify shopper numbers within that category, and can help gauge based on lookalike audiences the size and scale of the audience that may be interested in your product. Shelf-talkers are often placed within contextually relevant aisles in the store in hopes that the consumer will see an Rx product that they can use with greater effectiveness than the one they purchase OTC. Second to the shelf-talker is the in-store kiosk. Utilizing the same analytic base as shelf-talkers, kiosks can be placed at the point of pharmacy or front of store to grab shopper attention, provide QR codes to direct to digital interaction, or provide takeaway pamphlets, etc. to allow for consumers to do additional research and be further informed.

The other way that marketing programs are being built in store is through audio and visual. Major retailers have opened their intercom systems to allow for commercial reads over the airwaves to their consumers. This allows for exposure across the store of sixty seconds solely dedicated to your product. This can heavily influence a shopper who may be in an aisle and searching without any luck or prevent them from purchasing yet another ineffective OTC product. The second is visual. CMI Media Group has partnerships within aisle display programs that include a small TV with commercial capabilities to show the effectiveness of your product in a contextually relevant setting. The other visual method is to partner with the retailer and show your product in their technology section of the store using their “TV wall.” This can garner eyeballs to those that are shopping more generally and draw in an audience at exactly the right time.

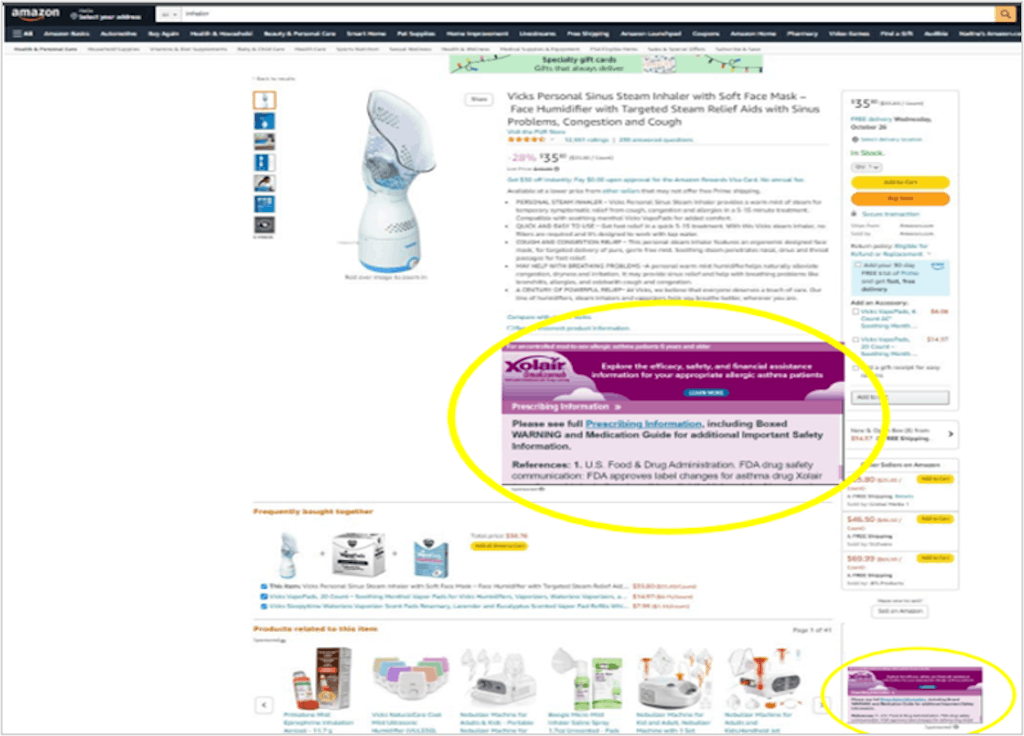

Though in-store executions have been favored by many, the digital landscape continues to evolve. The first way is in complementary programmatic and social efforts. Programmatic offerings through these online retailers include digital display units on the retailer website in contextually relevant areas to your product. The second is offsite display units through the retailer DSP or utilizing retailer audiences through our existing DSP audiences. This allows us to reach a new, qualified consumer base developed through script fulfillment at the point of pharmacy and point of sale analytics. The efforts in programmatic are nearly parallel to that in social when it comes to execution. One thing to note in the social area is that there is an opportunity for co-branded efforts. Retailers have allowed for co-branded marketing opportunity to allow pharma products to tie onto the brand identity of the retailer with the pre-established brand connection and trust to the patient.

The next step in digital pharma is going to be contextual based marketing when it comes to PoP. It will require brands to be smart in placing their products in areas where their competitors show, category level pages, pages that have products that are representative of a larger protocol for a disease state, and several other areas of the digital storefront. As these opportunities open themselves to a greater base, there also needs to be greater consideration to off-platform advertising that drives to the retailer whether that is through CTV, programmatic, search, or social. Major retailers such as Amazon and Walmart have already started these practices. Walmart, for instance, has opened up the opportunity to study the OTC landscape including keyword analysis to allow for a more complete and accurate targeting opportunity on platform for Rx products.

Audience & Measurement

There are other ways to begin marketing to patients without the need to extend to additional marketing efforts in retail-commerce. Two main factors here come down to audiences and measurement. Audience sharing is nothing new to the digital community. In fact, past practices were often purchasing large audience files shared between organizations for more effective targeting practices. Now that we can no longer do that, we must work together on anonymized audiences that we can push through different channels. One way is to work with a retailer to define particular audience types. This can include lookalike audiences of patients within a disease category, data of OTC shoppers, loyalty members, geo locations, and several other factors. By working with major retailers, we can leverage their audiences and push them through a DSP and use them in programmatic, have managed service options in social, and help to better define in-store executions based on foot traffic and the practices of consumers in those stores.

The second component is measurement. Pharma poses several challenges from a regulatory standpoint when it comes to measurement. However, leveraging retailer analytics, we can study and understand the landscape of OTC sales that run in the same category as Rx products we bring to market. This will provide insights into the number of products someone tries in a given period (e.g. allergy medications). If someone purchases several over a six-month period, they may be a perfect target for an Rx product in that category. These measurements will allow us to know market size based on dollars, shoppers. This can tell us whether we need to open up targeting to additional people (e.g. caretakers). It also allows us to know where else this patient/consumer is shopping. This can help us determine where on site we want to place advertisements.

Perhaps someone is looking at an NSAID which is part of a larger protocol for the disease state that they are in. We can then place marketing in that category as well to ensure we are reaching the consumer during their shopping journey. Measurement also comes in the way of script lift studies, Crossix integration and data, and search keyword impact. These three areas are significant. Understanding impact of the marketing we are doing during a given period through the use of a script lift test can tell us whether we are effectively hitting the correct target. Crossix and full funnel data on the patient journey can let us know whether we met the needs of the end consumer and drove a “conversion.” Finally, using keywords to understand how patients are getting to the products that they are choosing or finding our product can lead to a more efficient and effective marketing product not only on the retailer site but may have carryover to our efforts in SEM.

Cookieless Impact and 1st Party Data

How is this all possible, especially knowing we are going into a cookieless world in 2024? This is the power of retail 1st party data. Partnering with just Amazon and Walmart alone yields 44% of the entire US population of online shoppers. Being able to utilize the data that they collect on site from shopper experience, shopper journey, purchases, and more will allow us to leverage highly qualified audiences through on platform search and display marketing, off platform display, CTV, and co-branded executions in social. We can create a more personalized, safer experience for consumers/patients and still generate results with the largest digital consumer markets in the country.

Powerful, First to Market Opportunities

These opportunities, mentioned above, are only the start. It is a true “toe in the water” before being pushed in and fully submerged. Retailers are taking caution understanding the complexities of HIPAA and regulatory concerns when it comes to analytics. This makes offerings slower to market and requires more creativity by marketers and brands to understand the landscape and approach it with care. In-store efforts are a great way to begin partnerships with major retailers and develop a new audience base. Leverage those audiences in your digital offerings and as contextually based offerings open and become ironed out online, begin to leverage those audiences.

Major retailers want to feel their efforts are appreciated, which is often seen through a brand’s willingness to invest. If you look at the last decade, the brands that succeed on platforms such as Amazon were first to market, heavily invested, and tested several outlets and channels. While the landscape is much different than it was in the early 2000s, there is still a need to dedicate budget to testing, evolving the offerings with the retailer, and ensuring that you own the share of voice before your competitors creep in. Being early means lower CPMs/ CPCs, more space for connection with the audience, and greater opportunity for “conversion.” Those that don’t hesitate and understand this will see the same emergence that retailers did when marketplaces first opened.