State of Paid Social: Summer 2023

September 12, 2023

It’s been quite a summer for Social Media, what with all the changes: The Platform Formerly Known as Twitter (and currently known as X)…Reddit protests… Threads is taking over!…Threads is dying!… CMI Media Group is here to break it all down and guide Pharma marketers on implications and what’s next for Social.

Paid Social Landscape at a Glance

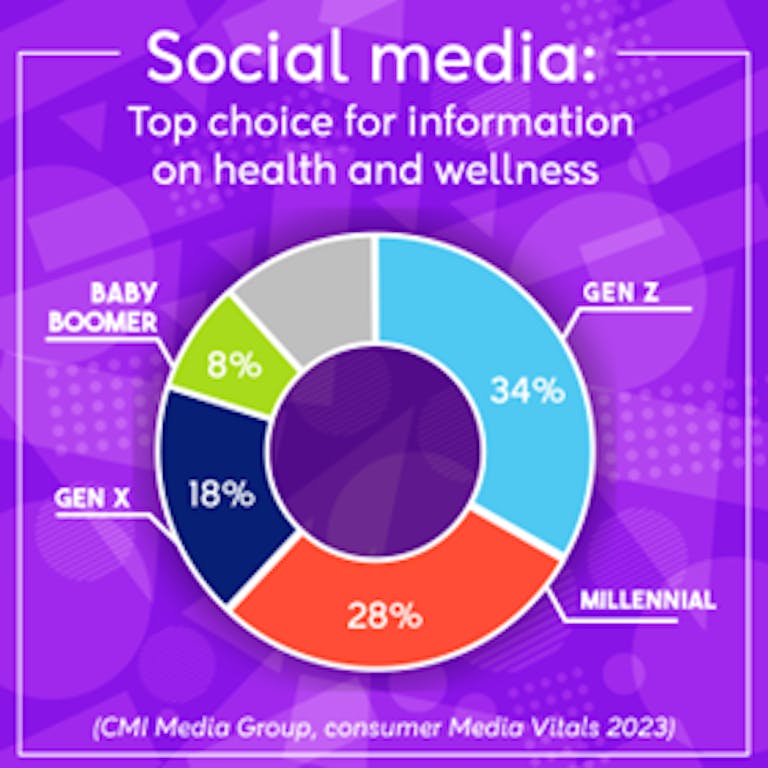

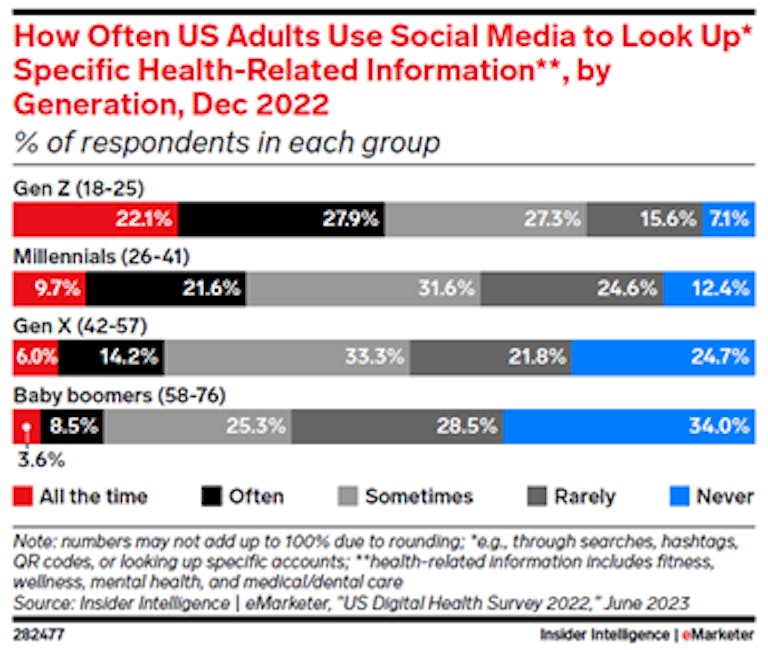

While paid social ad spend growth is slowing down, it continues to be a major component of advertiser media plans thanks to its flexible and dynamic cost model and, most importantly, the reach and engagement that comes along with it. It is also the digital channel of the future with one third of Gen Zers relying on social media as their top choice for information on health and wellness, per CMI Media Group 2023 Media Vitals study. Furthermore, close to half of Gen Z respondents turn to social media often or more to research health related information, per an eMarketer study, and 22% rely on social media all the time for this type of information – that’s compared to 10% of Millennials.

As noted, Gen Z is a driving force behind the usage of social media, and while Facebook saw its first decline in ad revenue last year, platforms like TikTok are seeing massive growth, thanks to the influx of users (not just Gen Zers) and time spent.

This POV will dive into the specifics on what’s been happening across the social landscape and all the social networks, and what healthcare marketers should be planning in the months to come.

X Doesn’t Mark the Spot

Planning around X (formerly Twitter) has been tough this past year due to the many changes and transitional environment. With the conclusion of Elon Musk’s acquisition of the platform in October 2022 came changes that led to major advertiser concerns around brand safety, that still plague the platform to this day. To catch you up, CMI Media Group put together a full timeline of major Twitter/X developments here. Since then, X has implemented safety measures to protect advertisers, which assuaged some advertiser concerns to return to the platform, but overall X has seen a 59% decrease in advertising revenue year over year.

Rebrand aside (and you can find our POV here), X has advertisers spinning and grappling with Verified Organizations (VO), the new verification and subscription model which the platform is positioning as a means to safeguard brands against bad actors trying to impersonate and misrepresent brands. Company/brand handles who pay for VO ($1K/month for an organization + $50/month for each “child” handle associated with the organization) receive a gold checkmark and square avatar as well as a host of other benefits. Companies that do not subscribe to VO will lose gold checkmark status unless they meet ad investment criteria put forth by X.

While the dust continues to settle, especially with the rebrand, CMI Media Group is advising clients to proceed with caution. Changes seem to be happening on the daily, and while X has promised a 6-week holdout for Pharma on any visible changes, it’s best for brands who are new to X to go in eyes wide open before investing with them.

For brands currently active or have been active, in most cases it’s safe to stay the course as long as brands are doing their due diligence on brand safety measures, including subscribing to Verified Organizations if they choose to maintain a presence but do not meet investment criteria.

To further protect brands, X recently announced some other advancements to its brand safety measures:

- Advancement of their partnership with Integral Ad Science with pre-bid verification within the context of the GARM Safety & Sustainability Framework. Previously this partnership only included post-bid measurement and reporting. This is currently in beta, but CMI Media Group is staying close with X on this offering for our clients as it continues to open up.

- In the coming weeks, advertisers will be able to select from 3 tiers of sensitivity settings to control the content in which ads are served adjacent to.

- An automated industry-standard blocklist to protect advertisers from appearing adjacent to unsafe keywords. This would be in addition to the CMI Media Group blocklist that we implement on every X campaign.

The Rise & Fall of Threads

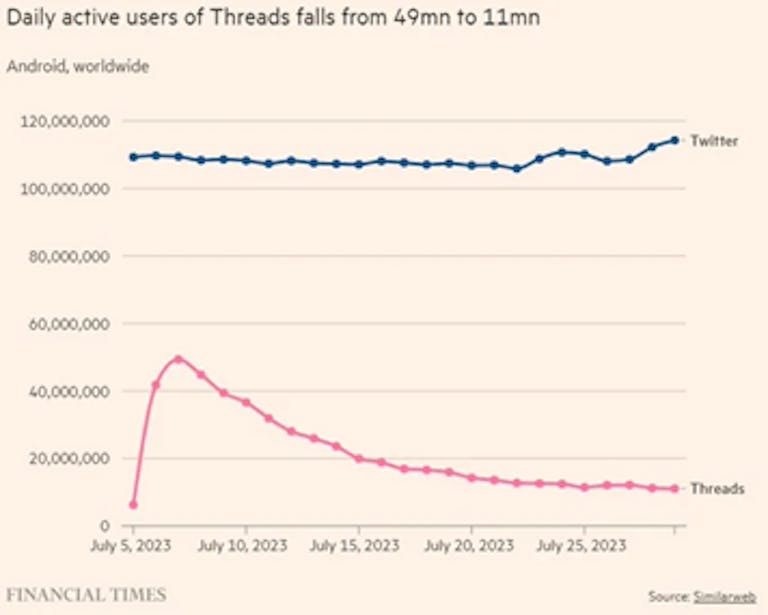

Meta is no stranger to taking a page from other social platforms. Case in point: Instagram Reels, Meta’s answer to TikTok, which has been a key focus for Meta and has seen tremendous growth and revenue as a result. When Meta announced the rollout of Threads, a clear takeoff of X, people ran to the new platform in droves, seeing 49MM daily active users at its peak. Not even one month later, the platform is seeing 1/5th of that amount.

We shouldn’t close the door on Threads just yet, but Meta should act fast to take advantage of the remaining momentum from its launch. To lure back its users, it really needs to focus on its value proposition for users. And with users, come advertisers. Although ads are not yet supported on Threads, it will inevitably be part of the Meta ads ecosystem, along with Facebook and Instagram, if things go right.

“Right” means building up its features which it’s currently lacking, especially when comparing to X. In CMI Media Group’s Threads POV we mention the lack of search, hashtag and mention capabilities which are especially important in the medical community who is looking to tag fellow HCPs and researchers, link to articles and studies and insert hashtags to bring together relevant medical conversations (e.g. #MedTwitter). It seems that Meta is on the same wavelength, as Meta CEO Mark Zuckerberg recently announced the addition of mention functionality as well as some other new features.

A wait-and-see approach is the path forward here as Threads continues to add functionality in hopes to draw back users and engagement to the platform.

Watch Out for Reels

Instagram is reportedly testing long-form Reels, doubling down on the TikTok inspired ad placement, which has helped bring in billions of dollars of ad revenue and is quickly becoming Instagram’s most popular placement. Lengthening Reels will not only up the competition against TikTok’s longer format spec capabilities but can also encroach on YouTube territory as well.

Protests to Reddit API Changes

In April this year, Reddit announced that they would begin charging developers for API access which led to a planned boycott of the platform over the course of two days in June where moderators for the site made their communities private or restricted posting. Users continued to protest by labeling multiple subreddits not safe for work (NSFW), affecting advertisements and resulting in administrators removing the entire moderation team of some subreddits.

In response, Reddit amped up its AI and systems to monitor and flag questionable content as well as proactive exclusion targeting to further protect advertisers. Any communities and moderators that were no longer following the platform’s Code of Ethics were also swiftly removed. Consequently, activity has normalized to pre-protest levels. Reddit continues to be an excellent platform for Pharma, with 400M+ monthly page views on health content and 700+ health-dedicated communities where Redditors can learn and share health-related information while maintaining their anonymity, especially for sensitive health conditions

LinkedIn Product Changes

While maybe not a big deal for most advertisers, CMI Media Group flagged platform visual changes and inconsistencies with LinkedIn that impact regulatory submissions and compliance. This included ad spec inconsistencies, inconsistent anchor video (“Watch & Browse”) functionality in Sponsored Content Ads and ads being truncated when clicking through to the landing page on iOS devices.

CMI Media Group provided feedback (and continues to do so) to LinkedIn’s Product Team and LinkedIn Health Leadership to get ahead of these seemingly innocuous updates. Additionally, we are actively pushing LinkedIn to create a Pharma “holdout” group which would delay any platform changes for Pharma brands and give them time to route changes through regulatory. This concept has been around for a while with Meta and was just implemented by X as a result of feedback provided by CMI Media Group to the head of sales.

These changes are a blip on the radar for a vertical that is relatively new and growing for LinkedIn. LinkedIn has long been a strategic partner of CMI Media Group Paid Social teams to reach HCPs in a non-endemic environment at efficient costs, including partnering on several Pharma firsts for the platform, such as launching branded messaging.

Pinterest Open to Pharma

Hot off the presses, Pinterest is now open to Pharma for advertising. Previously, branded and unbranded messaging was not allowed, but Pinterest has opened a beta testing opportunity for Pharma on the platform, starting September 5th.

With social media being bogged down by conversations of mistrust and negativity (mostly driven by X), Pinterest brings a breath of fresh air with its reputation of positivity, inspiration, and most importantly trust (Pinterest is ranked #1 overall in digital trust attributed vs. Competitors).

With Pinterest, brands can engage with 48 million content engagers and 98 million health related searches over a 12-month period in an audience base that is 20% more likely to prioritize their health with regular doctor visits vs. non-Pinterest users. Users are searching for lifestyle tips and inspiration to manage their everyday lives that might include chronic conditions such as diabetes or rheumatoid arthritis (e.g. “recipes for diabetic type 2”, “anti-inflammatory meals”).

Activation is Pharma friendly, with ad-only profiles and pins, meaning advertisers can run ads without managing a public profile and the moderation that comes with that. Additionally, commenting is not available on ads, nor is it a core engagement on the platform for organic pins, eliminating the need for comment moderation and management. Of all Pinterest’s targeting capabilities, keyword and 3P targeting will be essential, with the ability to activate audiences used for other social platforms on Pinterest (Pinterest also offers high unduplicated reach compared to other social platforms).

TikTok on the Rise

TikTok has seen massive ad revenue growth these last few years, bolstering the paid social space. CMI Media Group TikTok ad spend in 2023 increased 14x from 2021! Because of TikTok’s popularity with a social savvy Gen Z audience, authenticity in ads is and will be paramount to advertiser success (as opposed to the polished/curated content, as typically seen on Instagram). Advertisers should continue to explore partnering with influencers/creators who bring their own unique style and POV to relate with audiences in an authentic and relatable manner. Expect to see TikTok popping up more frequently on media plans, not only because of the reach and engagement, but also the pharma-friendly ad solutions that have been developed with pharma in mind.

BYOD (Bring Your Own Data)

While not unique to this past summer or year (or Social in general), data for targeting purposes is hard to come by these days. Native targeting, especially on Meta, has grown more limited (thanks Cambridge Analytica for kicking that off!) and platforms are pushing advertisers to bring their own first-party data to the platforms to diminish the onus that comes along with sourcing data. Outside of self-imposed targeting restraints, platforms are also dealing with influences beyond their control including iOS 14 tracking updates and the deprecation of the cookie by most web browsers.

With the dearth of qualified targeting options, it is imperative for advertisers to either bring their own first-party data to the social platforms (which is difficult when it comes to patient marketing) or partner with third-party data suppliers.

Fortunately, through CMI Media Group’s Empower Team, we have the data capabilities to activate audiences on most Social platforms. Health Model Targeting (HMT) supplements paid social campaign targeting to reach the right target audience in a privacy-compliant manner and at scale. These qualified lookalike audiences are built off of real-time claims data that is then able to be onboarded and activated on the social platforms. HMT allows our teams to create more personalized communications through audience segmentation, which further drives engagement and results for our clients.

Stay in the Know

With the ever-changing, dynamic landscape that is Paid Social, it is imperative for advertisers to stay close to all the ongoing updates and best practices, including the ones highlighted in this POV. Social listening allows advertisers to have their ears to the ground on what is trending and act quickly (e.g. shift strategy, tactics). Using social listening tools, CMI Media Group’s Social Intelligence Team has built out alerts to stay ahead of new trends and changes. Similarly, while the ability to read up on developments via media and news publications is important, it is even more important to get ahead of those changes with conversations directly from the source, which CMI Media Group can facilitate, in thanks to its close partnerships within each of the social platform’s leadership teams.